The US dollar is by far the most powerful currency in the world and the US Economy is so intertwined with the world economy that a minor fluctuation in the US economy creates a ripple effect all across the globe, that is why, overtime the Fed hike or decreases the interest rates, every time the US economy goes up or down, it goes on to create headlines in every single newspaper, the stock markets all around the world wobble and most importantly, the life of more than 3 billion people gets affected.

On top of that because of the Dollar, the United States is able to practice its super power to such an extent that they could literally uplift or cripple the economy of most countries within a fortnight.

So, how did the US dollar became so powerful and what exactly was the strategy deployed by the United Sates that gave America an unprecedented power over the global economy?

The story dates back to 1940’s when the world had already witnessed the World War-I and the World War-II was at it’s peak and the British Empire was the superpower during that time, with their vast colonies all across the world but by the time they fought World War-I and World War-II, most of their wealth had deteriorated. In fact by 1920, that is by right after World War-I itself, the condition of British economy was so bad that they went from 0.62 Billion Pounds of debt in 1913 to 7.8 billion pounds in 1930, which is from 25 percent of it’s GDP to 130 percent of it’s GDP and this was the case with all major countries all across the world including France and the Soviet Union, and the catch over here was that the United States government was so smart that they engaged in these wars first as war merchants and then as war participants. Now what does that mean? While all the big empires were busy fighting the war and dedicating all their manpower and resources towards warfare, the United States used all it’s capital and manpower into becoming the major supplier of wheat, rubber, cotton, brass, automobile, machinery and thousands of other goods to the world. As a result, the United States experienced one of the greatest economic booms in the world. The total value of US exports grew from just 2.4 billion dollars in 1913 to 6.2 billion dollars in 1917, and the same thing happened in World War-II also, wherein, the United States became a war merchant and entered the war only after Pearl Harbour.

So, by conducting a business out of two of the most expensive wars in world history, the United States made so much money that while every other country’s economy was devastated, the United States had 75 percent of the entire world’s monetary gold. Their Gold reserves went from just 2000 Tons in 1910 to almost 20,000 tons in 1914.

This is when the US took the opportunity to gather 44 countries all across the world to sign the Breton Woods Agreement in 1944, whereby 44 countries agreed to peg their currency against the Dollar and the US dollar was ultimately pegged to Gold.

What was the Breton Woods Agreement?

Well, Firstly, the Breton Woods agreement said that they would back the dollars with gold such that one ounce of gold would be 35 Dollars as in 28.35 grams of gold would be worth 35 Dollars and they said that, “If you own the Dollars and come to us, we would redeem it’s value in Gold, as in we would exchange the Dollars with the Gold”. So this way, it became extremely convenient for countries to do trade with each other even if they did not trust each other’s Government. But if the transaction happened in Dollars, the United States guaranteed the value of Dollars with Gold. So you could trade with any country with the US dollars and be rest assured that it could be used to trade with any other country to buy any other commodity.

Secondly, the Breton Woods Agreement led to the formation of two major organisations, the first was the World Bank and the second was the International Monetary Fund or the IMF. And since most of these countries were devastated by the two wars, they desperately needed loans to rebuild their economy, so with the funding of the United States, the World Bank issued huge loans to help these countries get back on track.

And Thirdly, these countries had the benefit of IMF facilities. So, while the world bank gave out long term loans for development, IMF keeps track of the Global economy, it assists policy makers and most importantly it lends to countries with balance of payment difficulties. This is the reason why even today countries like Pakistan and Sri Lanka are seeking help from the IMF to come out economic crisis.

This is how the Breton Woods Agreement sealed the importance of US dollar and gave the United States a huge leverage over other countries. This was the first phase of establishment of US dollar dominance.

US Dollar and Oil

The Second phase of US dollar dominance was established during World War-II, when Britain, Russia and US were busy fighting against Germany, Japan and Italy, the Arabs in the Saudi Arabia had nothing to do with war itself. In fact, they didn’t even know that they were sitting on the largest black gold mine in the world and during this time, that is, during the 1930’s and 40’s, American and British companies were serving the entire world for oil and only these companies actually had both the technology to extract the oil and the acumen to use it for world trade and development.

This is when in 1938, an American owned oil well in Saudi Arabia drilled into a huge source of oil reserve, meanwhile the Saudis were not at all rich back then because they had just started producing oil but during the war Italy dropped multiple bombs on Saudi to target the American facilities in that region and because of this attack the Saudis struggled to produce oil at full capacity, so the Saudis desperately needed more protection and this is when Franklin Roosevelt, who was the then president of the United States saw the insane levels of development all across the world during war and he realised that the key to this and the next five decades of world development lies in just one commodity, and that is Oil. So he held one of the most important meetings in world history with the king of Saudi Arabia and made a deal in 1945 that would save the fortunes of US dollars forever.

So, what was the deal? It’s very simple, the US offered to protect Saudi Arabia from any future attacks and provide them with all military equipments and in exchange he asked the Saudi king to sell oil only in US dollars and as it turned out, the Saudi well that the Americans were digging was the Largest Oil Well in the World and from there onwards the rise of Middle-East started and by 1960’s after OPEC, all oil exporting countries started selling oil in dollars.

Now the question is why was the selling of oil in dollars was such a big deal and how did this meeting made the US dollar the most powerful currency in the world?

Well this is where the third phase of rise of dollar comes in, when dollar became the king of all currencies. Now if you remember the Breton Woods Agreement, it said that if you peg your currency to the dollars, America would redeem it’s value in gold. But, by 1970’s the US economy had reached such a pathetic state that the gold reserves had fallen from 22,000 tons in 1950 to just 10,000 tons in 1970. This was because of multiple reasons like Vietnam War, Gold price hikes, US liabilities, etc. But in short, the US gold reserves were so low that they could no longer afford to keep exchanging gold for dollars and this is when president Richard Nixon declared a temporary suspension of the dollar’s convertibility into gold.

So now, all the countries were free to choose any exchange arrangement for their currency except pegging it’s value to the price of gold. So now, one of the most important factors for the value of a currency was not gold, but it’s application. As in, what could your currency buy you in the global market and from whom? And what could the US dollar buy you, well it could buy you the most valuable commodity of the century and that is Oil. So most of the countries by default held on to their forex reserves in US dollars, so that they could buy oil from the Arabs. But at the same time, other currencies like Euro, Yen and Yuan began to rise in world trade. On top of that, Now, European and American banks came up with something called the society for worldwide inter-bank financial telecommunications or the SWIFT network to make trade payments.

The working of SWIFT Network is such that, if you want to trade in US dollars then you have to have your forex reserves with the American banks. And this is the reason why today more than 200 countries have their forex reserves stored in American Banks. And the catch over here is that, if a country has 100 Billion dollars in forex and spends only 20 to 30 billion dollars in import and export, they would still have 70 billion dollars in surplus. So these countries invest their excess foreign reserves in US treasury bonds, so this becomes a mega bond whereby countries are lending billions of excess dollars to the US and expect a return after maturity.

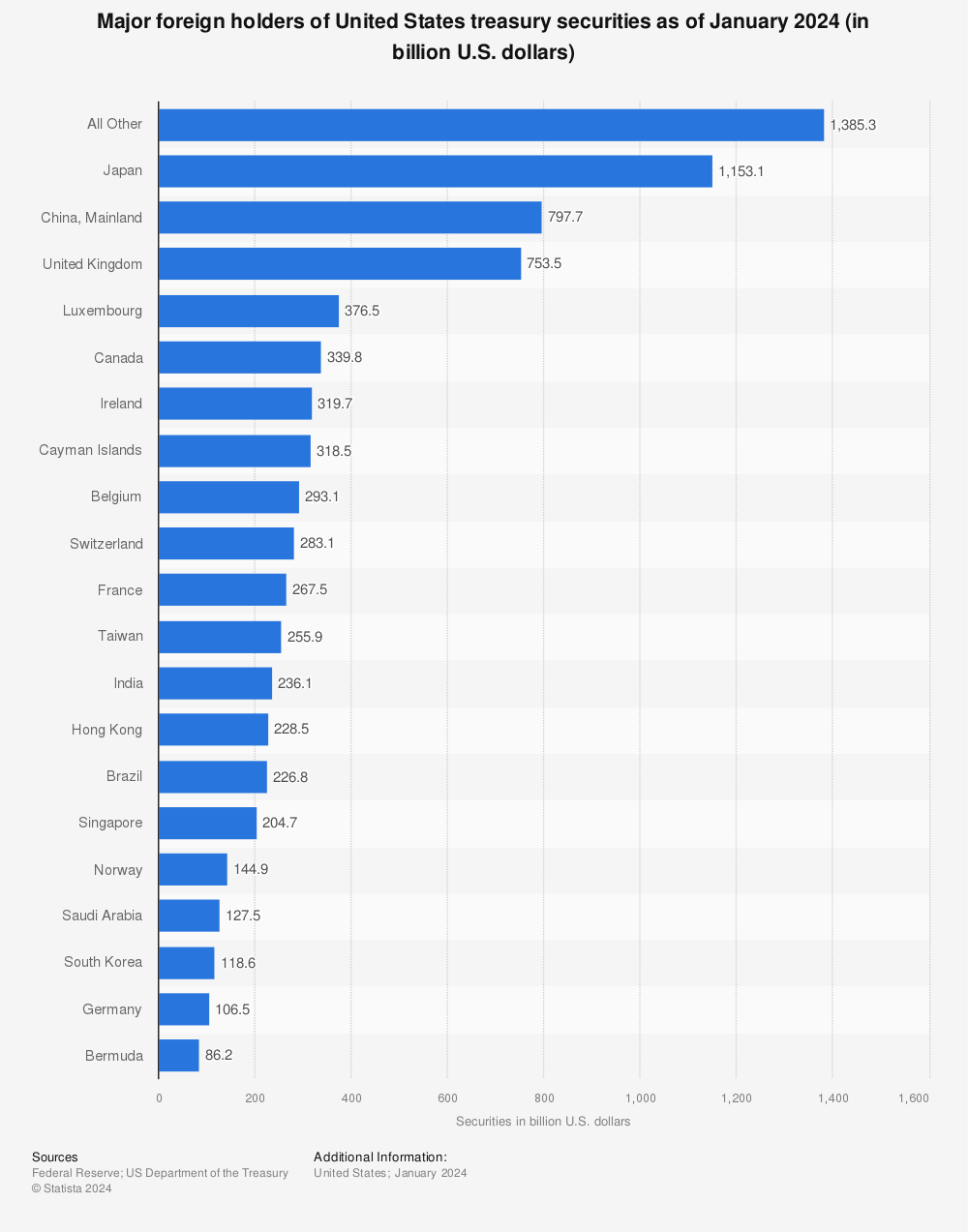

And if you look at this amount, as of May 2022, while Japan has 1.2 Trillion dollars in US securities, China holds 980 Billion dollars and UK holds 634 billion dollars. In total, the United States has seven trillion dollars held by foreign and international investors os of September 2021.

Find more statistics at Statista

So with this insane amount of cash, US has an unfair advantage to build it’s economy, develop it’s military, extend it’s loans to other countries, fund the World Bank and eventually command an extraordinary power over other countries. On top of that, if any country does something that the US do not like, they could just freeze their forex accounts and prevent them from trading with other countries, and this could practically cripple a country’s economy within a fortnight.

And if you know, this is how the US froze 300 billion dollars of Russian foreign reserves during Russia-Ukraine war. This is one of the most important reasons why the United States is hailed as the most powerful country on the planet and why US dollar is accepted as International Currency.